Creative Brief Summary

Now that the Creative Brief has been completed, we'll take a look at the answers we received.

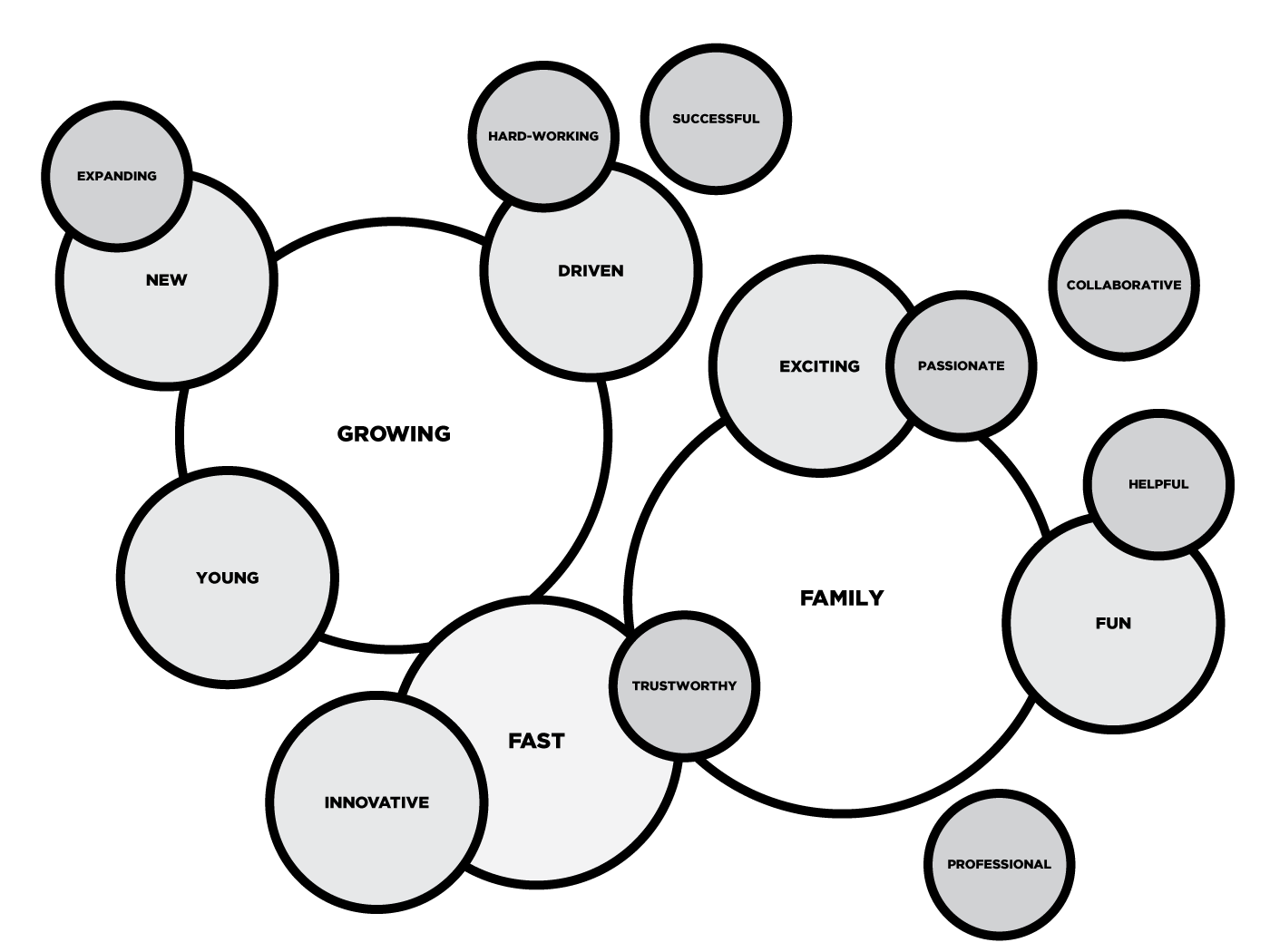

1. List 5 adjectives that best describe EnTrust Funding.

OTHER RESPONSES

Active

Agile

Ambitious

Casual

Close-Knit

Detailed

Determined

Diverse

Dynamic

Empathic

Energetic

Ethical

Forward-Thinking

Generous

Hustle

Inclusive

Learning

Lucrative

Motivated

Opportunity

Productive

Progressive

Responsible

Service

Strategic

Supportive

Thorough

Tireless

Unique

World-Domination

2. Off the top of your head, how would you describe the purpose of EnTrust Funding?

of responses mentioned helping or taking care of people

"Take care of the people."

"Simplifying and complicated lending process"

"To help people get into a better loan to better their financial stance. Put families and individuals in the best space possible."

"To help improve the lives of all our clients"

"Refinance and change lives"

"To provide opportunities for clients as well as team members"

"Helping Borrowers achieve financial success"

"To affect change in communities across America by changing lives and providing financial savings."

"to be a fun and lucrative place to work while making customers and employees financials goals come to fruition through hard work and dedication"

"Make mortgage personal"

"helping consumers achieve their financial goal"

"Assist bwrs with their mortgage needs"

"To help those who need it most"

"Have every employee have success"

"To help people better their financial health while making a good living"

"to ensure consumers are provided with a constant level of service to ensure they are put in the best financial position for themselves and their family in regards to their mortgage and refinance experience."

"People taking care of people"

3. Is your brand more casual or formal?

CASUAL

FORMAL

4. Is your brand more modern or classic?

MODERN

CLASSIC

5. Is your brand more reserved or bold?

RESERVED

BOLD

6. Who is EnTrust Funding's Ideal Consumer

TRAITS THAT WERE COMMONLY MENTIONED

Anyone

In Debt/Struggling Financially

Dreamers

Educated

Family-Oriented

"40, 700+, educated, Savvy"

""People person" borrowers. Those who need human interaction to help me sense of something complicated/scary"

"30-75- anyone with a mortgage that has dreams that they haven't achieved yet. Decent to great credit score."

"Existing and Future Homeowners"

"40+,680+(at the moment), any."

"I dont know if we have an ideal consumer. I feel like we have something for everyone. The older crowd seems to be more loyal to their existing mortgage holder though."

"any age (18+ to have a mortgage) but 25+, Mid 600s fico, people suffering from debt overload, the underdogs, people that really need our help"

"35, 720, working class, wants to make wise financial decisions to efficiently pay off home or use it as investment or to keep as long as he/she wants."

"40, 800, active and technologically savy"

"Really anyone. Anyone with a mortgage. Different products for retired v planning for v young and carefree"

"45, 740, parents and planning for a future"

"45, 700+, all types of lifestyles"

"50 yo, 620 fico, struggling financially"

"40, 650, spender, needs debt consolidation"

"Younger or older, the solution changes and is customized based on the consumers needs"

"50+ 620+ Family and retirement driven, someone that wants to better themselves and protect their family from financial hardships"

"40, 740+, well off, smart with money"

7. What are the top 3 benefits a consumer receives from choosing EnTrust Funding?

of responses mentioned SERVICE as a top benefit

of responses mentioned SPEED as a top benefit

of responses mentioned EDUCATION as a top benefit

OTHER COMMON RESPONSES

Attention

Caring

Honesty

Trustworthy

Knowledgable

8. When EnTrust Funding employees are connecting with a consumer what should they be focused on? Please rank the importance of the options below.

1

Building a strong relationship

2

Educating consumers on their options

3

Providing personal attention

4

Securing a loan/refinance plan

of responses chose "Building a strong relationship" as the most important focus.

of responses chose "Securing a loan/refinance plan" as the least important focus.

9. Is there an easy way for consumers to provide feedback on their experience with EnTrust Funding?

of respondents said yes

TOP 5 RESPONSES TO HOW CONSUMERS ARE ABLE TO PROVIDE FEEDBACK

1. Online/Google/Yelp

2. Asking for Reviews

3. Professional Review Boards (BBB/CFPB)

4. Email

5. Website

10. What qualities do you think an ideal EnTrust Funding banker should have?

of responses mentioned HARD-WORKING as an ideal quality

of responses mentioned TRUSTWORTHINESS as an ideal quality

of responses mentioned KNOWLEDGEABLE as an ideal quality

OTHER COMMON RESPONSES

Customer Focused / Service

Driven

Helpful

Hungry

Ready to Learn

Team Player

11. What is EnTrust Funding's biggest strength?

of responses mentioned EnTrust's employees or leadership are the company's biggest strength

"Marketing"

"Our people"

"Ability to help people change their lives."

"strength of will"

"the core, starting from exec staff down to managers"

"Our ability/willingness to adapt"

"Knowledge of staff and forward thinking technology/ideas"

"Adaptation"

"leadership team - experience and vision"

"The camaraderie and the fact that we will go the extra mile."

"ability to shift quickly, ability to grow and maintain its culture"

"We put our people 1st"

"ability to pivot/customers best interest in mind"

"its people"

"Ambition and Drive"

"their Training departments and executive staff with a combined over 50 years of experience and their training and development department that does extensive continuing education."

"Our Processing"

12. What is EnTrust Funding's biggest weakness?

of responses mentioned growing pains as the company's biggest weakness

"growing pains"

"Our branding/ Technology (both are being worked on)"

"Needs an army to help deploy."

"the unknown"

"transparency, although it has gotten much better over the last couple months"

"Communication/consistency between departments"

"lack of communication as a whole ( from internal to customer facing communication from the bankers)"

"Alignment"

"We're trying to do a lot in a short period of time while being "new""

"We all take on alot."

"competing on pricing with other institutions, lack of in office I.T."

"still in our infancy stages"

"still in the growing phase"

"brand recognition"

"Communication"

"Brand recognition or the lack there of."

"Cost, and newer bankers"

13. If your organization was a well-known movie character, who would it be?

of responses mentioned an action hero

of responses mentioned a Marvel or DC superhero

The majority of chosen characters are intelligent, heroic, impressive, with strong morals and values.

"Denzel Washington in anything"

"David Wooderson"

"Oh boy, someone from the Godfather or Rocky."

"maverick"

"batman"

"Michael B. Jordan"

"Michael B Jordan after Creed 1"

"Ironman"

"batman"

"Simba"

"Buzz Lightyear"

"Maximus in Gladiator"

"Captain America"

"Neo, The Matrix"